- #HOW TO CALCULATE GST IN EXCEL HOW TO#

- #HOW TO CALCULATE GST IN EXCEL SERIES#

- #HOW TO CALCULATE GST IN EXCEL DOWNLOAD#

Press Enter and the amount of sales tax appears in the cell you selected.

#HOW TO CALCULATE GST IN EXCEL HOW TO#

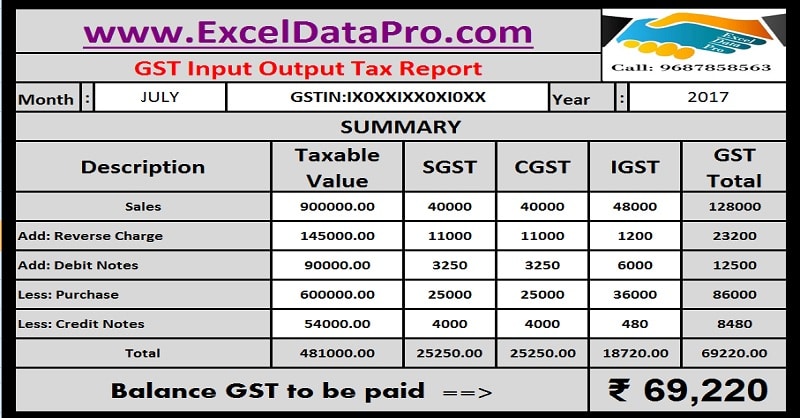

learningcenter GST ExcelIn This Excel training you will learn How to Calculate GST on Sales. How to Calculate GST Tax Liability using Excel Template in a Minute - YouTube GST: Now, interest to apply only on net cash liability of unpaid GST Calculator. Press Enter and the amount of sales tax appears in the cell you selected. Calculate GST on SALES in Excel by learning center in Urdu/hindi. 4 Click on Calculate option to calculate the final amount of the product. How do I calculate GST from a totalThe formula for GST calculation: Add GST: GST Amount (Original Cost x GST)/100.

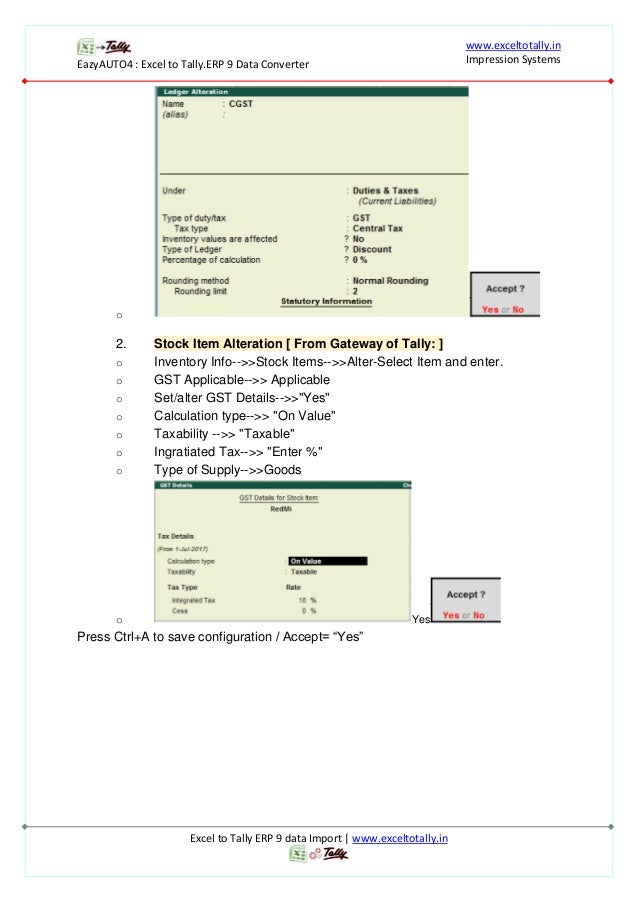

3 Select GST percent rate applicable on the product. Thus, a simple formula arises: GST Amount (Original CostGST Rate Percentage) / 100. For example consider the product on which 12 GST is. 2 Enter the original amount of the product. To calculate GST in excel you must know the percentage of GST applicable on the product or services. Later in this tutorial, well use the Grades worksheet. Method to use Online GST calculator tools: 1 Select GST Inclusive / GST exclusive option as required by the user.

#HOW TO CALCULATE GST IN EXCEL DOWNLOAD#

Input the data as follows (or start with the download file 'percentages.xlsx' contained in the tutorial source files).This worksheet is for Expenses. How to calculate GST manualy You have price without GST and you need to calculate final price including GST: baseamount is a price before GST is applied. Income from Salary (salary paid by your employer) How to Calculate Percentages in Excel with Formulas.Use the mouse to drag the fill handle (the small black square at the bottom right of the start cell) across the range of cells to be filled When you drag the fill handle across the range of cells to be.

#HOW TO CALCULATE GST IN EXCEL SERIES#

To calculate Income tax, include income from all sources. The Excel Autofill feature can be used to populate a range of cells with either a repeat value, a series of values, or just a cell format. Use the IF function to calculate with different tax rates

0 kommentar(er)

0 kommentar(er)